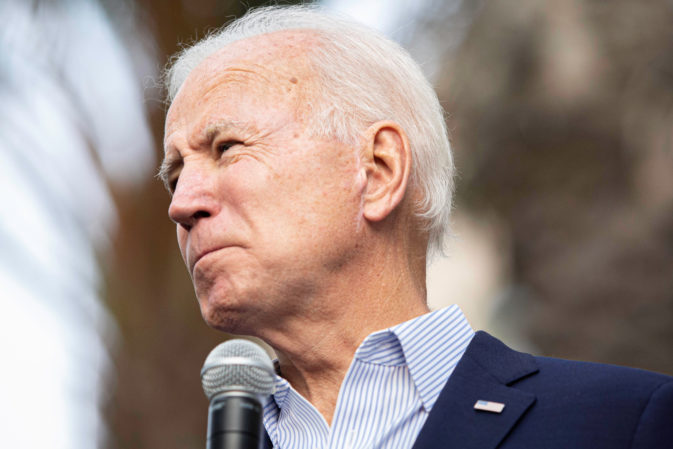

Biden’s Tax Hike Actions Speak Louder than His Words About Helping Small Businesses

President Biden’s speech in Chester, Pennsylvania today about helping small businesses couldn’t have come at a more ironic time. Biden’s remarks, part of a seven-day, seven-state “Help is Here” tour to sell the recently passed $1.9 spending blowout, coincided with reports that the Biden Administration is simultaneously preparing to execute the biggest federal tax hike in 30 years.

To add insult to injury, Biden is reportedly set to announce massive tax increases on the very small businesses he’s supposedly here to help. Don’t expect the mainstream media to pick up on this contradiction.

In his remarks, Biden touted the Covid-19 legislation’s financial aid for small businesses. Biden conveniently ignored how the Trump administration was responsible for the nation’s biggest small business boost over the last year, the Paycheck Protection Program, which has distributed roughly $700 billion to more than seven million small businesses, saving tens of millions of jobs. Businesses that needed a lifeline during the pandemic have the PPP and President Trump to thank.

Yet with the economy reopening and the virus threat receding, American entrepreneurs will no longer need government aid. Their main challenge will revert to the perennial one of contending with bad government policies. If Biden truly wants to help small businesses, he’d have announced in his speech that he’s shelving his tax plan and embracing President Trump’s tax cuts instead.

Biden said that he’d eliminate Trump’s tax cuts on Day 1 in office. Disingenuously, he’s also promised not to raise taxes on those earning less than $400,000 per year. So what does he propose to do with the bulk of Trump’s tax cuts that help the middle class? Biden has been cagey in his answer — until now. Bloomberg suggests that his tax plan will cut Trump’s 20 percent small business deduction, selling out job creators to left-wing activism.

By allowing small businesses to write off 20 percent of their qualified business income, this tax cut allows Main Street small businesses to better compete with their big business and international competitors. They have used these funds to expand, hire, and raise wages, fostering the pre-pandemic economic boom of historically low unemployment and rapidly increasing wages. Between 2017 and 2019, 6.6 million Americans emerged from poverty. Because this tax deduction generally phases out for small businesses earning more than $330,000 (when filing jointly), it’s squarely directed at the middle class.

Biden’s tax plan also promises to raise taxes on small businesses structured as corporations by 33 percent. Because his tax increases on higher incomes aren’t indexed to inflation, they will quickly hit the middle-class and ordinary small businesses in the years to come. His plan to nearly double the capital gains tax rate on high earners will result in less job creation because it will redirect capital from entrepreneurship to the federal government.

Democrats can ram through these tax hikes with their simple majorities in Congress. Only by small businesses speaking up about what these tax cuts mean for their employees and communities can they be saved.

That means telling the compelling tax-saving stories of ordinary small businesses like HM Manufacturing in Illinois, Sergio’s Family Restaurants in Florida, HT Metals in Arizona, and Guy Chemical in Pennsylvania. Making the case that tax cuts work can peel off moderate Democrat Senators like Joe Manchin, who said in January that repealing Trump’s tax cuts now would be “ridiculous.”

Biden’s tax hike actions speak louder than his words today about helping small businesses. His “Help is Here” roadshow, coming amid his tax hike push, brings to mind President Reagan’s warning, “The nine most terrifying words in the English language are: ‘I’m from the Government, and I’m here to help.’”