Biden’s tax hike would devastate small businesses

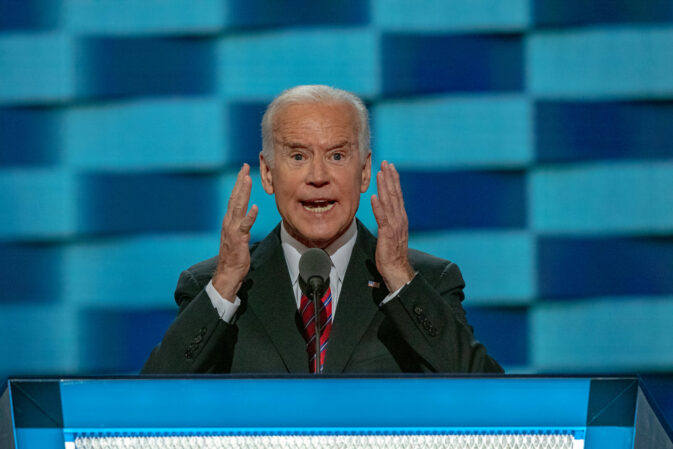

At his Wednesday evening address to a Joint Session of Congress, President Biden opened a new front in his war on small businesses by announcing a slew of new tax increases that would punish job creators. The proposed tax hikes are part of Biden‘s new American Families Plan, a $1.8 trillion spending blowout that rewards his union donors who contributed $27.6 million to get him elected.

This spending plan is Part II of Biden‘s so-called “infrastructure” effort. The first installment — the American Jobs Plan — is also paired with dramatic tax increases on small businesses. Together, these tax hikes would devastate small businesses and destroy the economic recovery that Biden has already slowed with his existing social spending.

The American Families Plan would raise taxes on small businesses structured as pass-through entities, hiking their top rate to 39.6 percent (43.4 percent including the Obamacare tax). These entrepreneurs would pay more than $43 out of every additional $100 they earn directly to the federal government. In high-tax states, small companies would have to pay more than half their income to the government. For these job creators, the economy will officially become more socialist than capitalist.

Biden also wants to nearly double the capital gains tax rate to 39.6 percent (43.4 percent including the Obamacare tax), punishing small business investment that creates jobs and economic growth. These capital gains taxes are especially pernicious because they don’t adjust for inflation, meaning that small businesses are punished for phantom gains in value over the course of many years. This capital gains proposal is the equivalent of a success tax, penalizing small business owners who have worked their entire lives to grow their companies.

Biden‘s capital gains plan would also end the tax treatment known as the “stepped up” basis for the children and grandchildren of small business owners, saddling them with enormous tax liabilities. Biden‘s claim that he’d protect descendants who continue to run businesses from this tax hike is a tacit admission of just how burdensome it is. Biden plans to massively scale up IRS enforcement so more agents could harass small businesses, just like they did to free-market groups under President Obama.

These new tax proposals come on top of Biden‘s existing goal, as part of his American Jobs Plan, to raise taxes by 33 percent on roughly one million small businesses structured as corporations. This hike would make it more difficult for affected companies to compete with their international counterparts that face far lower taxes. Economic research suggests workers and customers would ultimately bear most of this corporate tax burden.

These tax increases would hurt small businesses at the worst possible time, just as they’re finally ready to reopen fully after more than a year battling pandemic restrictions. By sucking resources away from Main Street, these tax hikes would reduce economic opportunities for ordinary entrepreneurs, employees, and communities. With hundreds of thousands of fewer small businesses and millions of fewer workers than at the beginning of last year, these tax hikes would deal a body blow to an already wounded economy.

Biden claimed last night that his policies are helping the economy rebound. But small business owners tell a different story, highlighting how extended federal unemployment benefits, passed last month as part of Biden‘s American Rescue Plan, are contributing to a major labor shortage. Desperate small businesses are resorting to payments for job interviews or $2,000 hiring bonuses to try to attract labor. John Motta, Chairman of the Coalition of Franchisee Associations, calls the labor shortage “the pandemic of 2021.”

“The government is making it easy for people to stay home and get paid,” said Tom Taylor, owner of Sammy Malone’s bar and restaurant near Syracuse. “You can’t really blame them much. But it means we have hours to fill and no one who wants to work.” Biden‘s generous payouts are the reason why several hundred thousand Americans file for unemployment benefits every week, while small businesses are desperate to hire.

In contrast to the rosy picture Biden painted last night, his social spending is slowing the economic recovery. And his small business tax offensive would reverse it.

Alfredo Ortiz is president and CEO of the Job Creators Network.