Biden’s student loan bailout will do nothing to address high college costs

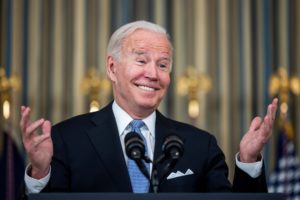

Last week, the Fifth Circuit Court of Appeals dealt another blow to the Biden administration’s illegal student loan bailout. The panel of three judges—one of which was appointed by Obama—denied the White House’s request to allow the government to disburse forgiveness payments while the court considers the program’s legality. A couple days later, the Biden administration requested the U.S. Supreme Court review the case—legal action brought by my organization, the Job Creators Network Foundation.

Good. The merits of our case are strong. As Federal Judge Mark Pittman previously put it, the program is “one of the largest exercises of legislative power without congressional authority in the history of the United States.” The bailout also sidesteps the rulemaking process outlined by the Administrative Procedures Act.

But beyond the legality—or lack thereof—of the executive branch’s unilateral action, it’s bad policy regardless of what entity quarterbacks it. The program does nothing to address out-of-control college tuition costs that are plaguing America’s young people. The one-time payment is akin to applying a Band-Aid to a gushing wound that requires stitches to avoid bleeding out.

How bad is the gash? Since the year 2000, the average cost of tuition and fees to attend college has ballooned by more than 140 percent. One analysis finds college costs are increasing nearly eight times quicker than wages. And as prices rise, students have pushed the envelope on borrowing. Since 2003, the average amount of debt strapped to university graduates has grown by two-thirds—approaching $30,000. And that doesn’t even include borrowers who dropped out of college before earning a diploma.

Actions taken in 2010 didn’t help the matter. The Obama administration expanded the federal government’s tentacles into the student loan business—making Uncle Sam the primary distributor of financial aid. The move stripped private banks out of the equation, which allowed more easy money to enter the system.

Where is all the money going? Hint: the extra cash flowing from borrowers to university coffers isn’t improving classroom studies. The outrageous tuition prices are instead funding lavish university officer salaries, an army of administrators who provide little to no value, and resort-style amenities. Do students studying biology really need a waterpark on campus?

If implemented, the student loan bailout will only encourage more extravagant spending that will require even higher tuition prices to maintain. It signals to both university leaders and future students that more easy money is in the pipeline. Once the floodgates open, students can borrow knowing they won’t have to pay it back later—a dynamic that colleges will surely take advantage of.

Instead of a $400 billion bailout that will do nothing to help rein in the cost of higher education, the federal government should reform existing programs intended to help young Americans attend college. Rather than offering what is effectively a blank check to prospective students, government-backed loans and financial aid should be more targeted.

Candidates from low-income families with the academic credentials to perform well at a university should be given the opportunity. But colleges should have some skin in the game too. Universities should be responsible for directly lending a portion of student loans. That way, they have a financial stake in the job market success of their alumni.

In parallel, high schools should do a better job of promoting alternative, more affordable education paths to students. Attending a less expensive community college with the option to follow-up with two additional years at an in-state university is one example.

The Biden administration’s student loan bailout brings a quote from Alex de Tocqueville to mind: “The American Republic will endure, until politicians realize they can bribe the people with their own money.”

In that spirit, I challenge President Biden, Secretary Cardona, Consumer Financial Protection Bureau Director Chopra, Senator Elizabeth Warren—who has been so outspoken on loan transparency—and the heads of major universities to pursue concrete reforms that drive down tuition costs, rather than engaging in a stunt to bribe the electorate.

Elaine Parker is the President of the Job Creators Network Foundation.